Miro Teardown: International Walkthrough

A visual review of Miro's international customer journey

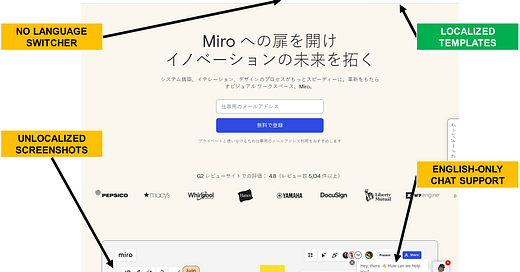

Miro is a text-book example of product-led growth success, but how effective is its international go-to-market motion?

Miro was founded in 2011, but to most people, it gained broad adoption and popularity during the COVID pandemic. Between 2020 and 2022, Miro experienced a staggering 600% user count growth, offering a delightfully simple way to collabora…